OCBC BANK IS FIRST IN SINGAPORE TO LAUNCH VOICE-POWERED CONVERSATIONAL BANKING

OCBC Bank’s retail customers can now ask Siri

to check their bank balances, credit card overview and make e-payments

to check their bank balances, credit card overview and make e-payments

OCBC bank customers can now ask Siri to check

their bank balances, credit card overview and make e-payments. Click image for

video press release.

their bank balances, credit card overview and make e-payments. Click image for

video press release.

Singapore, 23 February 2018 – “Hey Siri, what’s my bank balance?”

OCBC Bank is the first bank in Singapore to

enable its customers to do their day-to-day banking and make cashless payments

using just their voices. OCBC Bank’s retail banking customers are now able to

check their bank account balances, outstanding credit card balances and

details, as well as make instant e-payments to friends and family – using Siri,

Apple’s virtual assistant.

enable its customers to do their day-to-day banking and make cashless payments

using just their voices. OCBC Bank’s retail banking customers are now able to

check their bank account balances, outstanding credit card balances and

details, as well as make instant e-payments to friends and family – using Siri,

Apple’s virtual assistant.

The e-payments can be made instantly to any

bank account in Singapore, including bank accounts not linked to the PayNow

service. PayNow is a nationwide peer-to-peer funds transfer service that

enables funds transfers using mobile or NRIC numbers. This latest innovation is

in direct response to how customers are increasingly using voice assistants on

their mobile devices. In October last year, OCBC Bank rolled out a similar

service to business banking customers.

bank account in Singapore, including bank accounts not linked to the PayNow

service. PayNow is a nationwide peer-to-peer funds transfer service that

enables funds transfers using mobile or NRIC numbers. This latest innovation is

in direct response to how customers are increasingly using voice assistants on

their mobile devices. In October last year, OCBC Bank rolled out a similar

service to business banking customers.

Customers using the latest version of the OCBC

Mobile Banking App can check their bank balances and credit card details by

simply saying, “Hey Siri, what’s my balance?”, or “How much money do I have in

my bank account?”, or “What is my credit card spend?”. They can then

authenticate the transaction with their fingerprint or facial recognition.

Similarly, a customer using the most updated version of the OCBC Pay Anyone app

can make a funds transfer by telling Siri whom to send the money to and how

much to send, and then validate the transaction using their fingerprint or

facial recognition.

Mobile Banking App can check their bank balances and credit card details by

simply saying, “Hey Siri, what’s my balance?”, or “How much money do I have in

my bank account?”, or “What is my credit card spend?”. They can then

authenticate the transaction with their fingerprint or facial recognition.

Similarly, a customer using the most updated version of the OCBC Pay Anyone app

can make a funds transfer by telling Siri whom to send the money to and how

much to send, and then validate the transaction using their fingerprint or

facial recognition.

This voice banking innovation was developed by

OCBC Bank’s in-house mobile developer and E-Business teams. The service is

available to all OCBC Bank customers using iPhone devices running at least the

iOS11 software and the latest versions of the OCBC Mobile Banking and OCBC Pay

Anyone apps. Authentication using facial recognition is only available on

iPhone X devices.

OCBC Bank’s in-house mobile developer and E-Business teams. The service is

available to all OCBC Bank customers using iPhone devices running at least the

iOS11 software and the latest versions of the OCBC Mobile Banking and OCBC Pay

Anyone apps. Authentication using facial recognition is only available on

iPhone X devices.

Mr Aditya Gupta, OCBC Bank’s Head of

E-Business Singapore, said: “This is the new digital – conversational, more

natural and faster access to banking! This latest service marks a major

milestone in banking as it brings us one huge leap closer to making natural

language voice-activated banking and payments a reality. This is just a start –

we will continue to embed ourselves in our customers’ everyday lives using

voice-powered AI tools which they will be able to use for more banking

transactions such as bill payments, money management and common servicing

requests in the future!”

E-Business Singapore, said: “This is the new digital – conversational, more

natural and faster access to banking! This latest service marks a major

milestone in banking as it brings us one huge leap closer to making natural

language voice-activated banking and payments a reality. This is just a start –

we will continue to embed ourselves in our customers’ everyday lives using

voice-powered AI tools which they will be able to use for more banking

transactions such as bill payments, money management and common servicing

requests in the future!”

OCBC Bank has constantly worked towards making

banking seamless and embedded in our customers’ natural behaviour and

interactions. OCBC Bank was the first bank in Singapore to introduce biometric

authentication to access bank account details with OCBC OneTouch in March 2015,

and OCBC OneLook in November 2017 on the OCBC Mobile Banking app, leveraging

fingerprint and facial recognition technology. OCBC Bank offered customers the

convenience of banking on their wrist, with our mobile banking app for Apple

Watch in March 2016. In November 2016, OCBC Bank enhanced OCBC Pay Anyone by

enabling customers to send money via OCBC Pay Anyone directly within Apple’s

iMessage on iPhones, and via any app on Android devices using the OCBC Keyboard

in August 2017.

banking seamless and embedded in our customers’ natural behaviour and

interactions. OCBC Bank was the first bank in Singapore to introduce biometric

authentication to access bank account details with OCBC OneTouch in March 2015,

and OCBC OneLook in November 2017 on the OCBC Mobile Banking app, leveraging

fingerprint and facial recognition technology. OCBC Bank offered customers the

convenience of banking on their wrist, with our mobile banking app for Apple

Watch in March 2016. In November 2016, OCBC Bank enhanced OCBC Pay Anyone by

enabling customers to send money via OCBC Pay Anyone directly within Apple’s

iMessage on iPhones, and via any app on Android devices using the OCBC Keyboard

in August 2017.

OCBC Pay Anyone e-payment amounts have grown

400% in the last year. The number of OCBC Pay Anyone users has increased more

than 150% since early 2017. As Singapore ramps up its Smart Nation ambitions

with e-payments as a key thrust, OCBC Bank has consistently heeded the

government’s call to make payments more integrated, increasingly convenient and

secure by leveraging biometric technology and the latest innovations developed

for mobile devices.

400% in the last year. The number of OCBC Pay Anyone users has increased more

than 150% since early 2017. As Singapore ramps up its Smart Nation ambitions

with e-payments as a key thrust, OCBC Bank has consistently heeded the

government’s call to make payments more integrated, increasingly convenient and

secure by leveraging biometric technology and the latest innovations developed

for mobile devices.

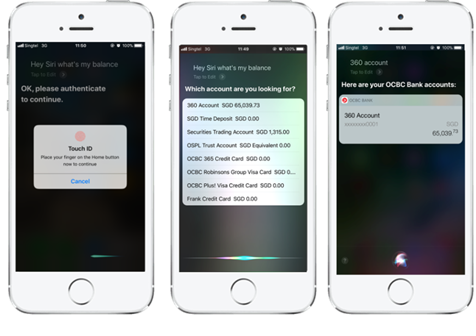

Checking bank balances via Siri

Checking current or savings accounts:

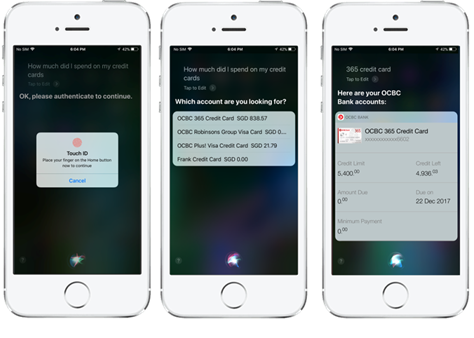

Checking credit card spend:

Step 1: Ask Siri to check account balance or

credit card spend

credit card spend

Step 2: Authenticate the transaction with

fingerprint or facial recognition

fingerprint or facial recognition

Step 3: Tell Siri or click on the account you

want information on

want information on

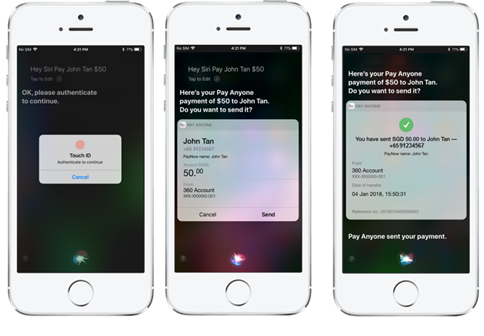

Making a payment via Siri

Step 1: Tell Siri whom you want to make a

payment to, and how much to send

payment to, and how much to send

Step 2: Authenticate transaction with

fingerprint or facial recognition

fingerprint or facial recognition

Step 3: Confirm the payment information, and

tell Siri to “send”, or click “send”

tell Siri to “send”, or click “send”

This is the latest in a series of digital

innovations that OCBC Bank has introduced to make day-to-day banking and

payments more seamless, fast and accessible for customers.

innovations that OCBC Bank has introduced to make day-to-day banking and

payments more seamless, fast and accessible for customers.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!