SINGAPORE, 10 November 2017 – UnionPay is casting its vision for the future of e-payments with a technology showcase at the upcoming Singapore Fintech Festival (SFF) 2017 held from 13 to 17 November. Featuring UnionPay FacePay – a new face recognition technology that enables users to pay for purchases by taking a photo of their face; Sound Code – a new technology that encodes data into ultrasonic sound waves to enable interactive payments for users; Virtual Reality – a new application that allows retailers to visualise in-store layouts and the integration of new payment technologies prior to implementation; and an enhanced Risk Management System – which helps issuers and acquirers verify consumer data and evaluate creditworthiness in real-time to manage the risk of card fraud; these technologies are being tested in real-life scenarios in partnership with brands in Asia, offering visitors a glimpse into the future of e-payments.

|

FACEPAY

|

|

|

Developed for attended and unattended sales scenarios, UnionPay FacePay enables users to pay for their purchases by leveraging face recognition technology. Users can link their facial identity to their payment accounts, and make hands-free payment by taking a photo of their face using the FacePay-enabled system. With a wide variety of potential applications in the food & beverage (F&B), retail industries as well as in unattended scenarios such as unmanned vending machines and more, this technology is being tested in partnership with LinkFace, and aims to be rolled out in Asia in the near future.

|

|

SOUND CODE

|

|

|

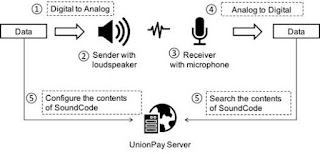

UnionPay’s Sound Code is an interactive, open platform solution built upon sound wave technology. Sound Code enables users to encode data into ultrasonic sound waves, and transmit them to the receiver, before being decoded into readable data. Sound Code also enables users to conduct more precise audience targeting, facilitate multimedia interaction, push out information, payment and e-vouchers to partners. Potential applications of Sound Code include:

- Enabling the purchase of an outfit worn by a character on a TV show;

- Ordering food via an online menu sent from a device using a discrete ultrasonic wave to the user’s mobile device; and

- Receiving information on an actor’s film accolades while watching his movies.

|

|

VIRTUAL REALITY

|

|

|

Developed primarily for retailers to visualise in-store layouts and the integration of new payment technologies prior to actual implementation, UnionPay’s Virtual Reality solution is built using Unreal Engine 4 and the HTC Vive headset. By immersing users into a virtual retail environment modelled after the real world, UnionPay envisions a future where payment services will be integrated within the virtual reality space, enabling password-free payment based on biometric identification or computer vision. This solution is currently being tested in partnership with Beijing Sureal Network & Technology Co. Ltd, and will be rolled out at clothing and grocery stores in China, followed by implementation in other markets in Asia.

|

|

RISK MANAGEMENT SYSTEM

|

|

|

As a holistic risk management system that helps issuers and acquirers improve their fraud mitigation procedures, UnionPay’s enhanced Risk Management System now features risk-based authentication, real-time fraud interception and near real-time card risk monitoring. The enhanced system not only helps issuers and acquirers verify consumer data in real-time, but also enables them to evaluate creditworthiness and personal credit risk to better manage the risks of card fraud and fraudulent use.

|

“As a global payments brand focused on realising the vision for a cashless society, UnionPay continuously innovates by working with developers and partners to conceptualise new payment solutions that can enable convenience and ease of e-payments for consumers around the world. Through extensive research, rigorous testing and trial, our aim is to connect consumers, businesses and financial institutions with cost-effective and secure payment technologies that will define the world of payments. These technologies, showcased at the Singapore Fintech Festival 2017, marks the beginning of more payment innovation to come, as we intensify our efforts in harnessing artificial intelligence, big data, blockchain, cloud and other technologies to enable quicker, safer and more seamless payments for consumers and businesses,” said Mr. Shuan Ghaidan, Director of Products, UnionPay International.

UnionPay’s technology showcase at SFF 2017 is located at 1F-15.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!