OCBC BANK LAUNCHES CASHLESS QR CODE PAYMENTS WITH ITS FIRST STANDALONE MOBILE PAYMENTS APP

The popular OCBC Pay Anyone e-payment services – which includes a new QR code cashless payment service – are consolidated into a standalone mobile app for our customers’ convenience

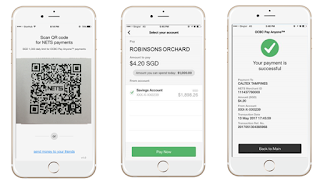

New way to pay: The OCBC Pay Anyone app enables customers to scan QR codes to make cashless e-payments directly from their OCBC Bank accounts to merchants.

Singapore, 30 May

2017 – OCBC Bank has launched

its first standalone mobile payments app which makes QR code cashless payments

available at close to 2,500 NETS terminals. The new standalone OCBC Pay Anyone

app brings together all OCBC Pay Anyone services and enhancements – peer-to-peer

e-payments, QR code payments and access to OCBC Pay Anyone integrated with

Apple iPhone’s Siri and iMessage – into a fast and easy one-stop access to

e-payments. With the app, customers can simply scan QR codes at participating

merchants’ NETS terminals to pay for their purchases directly from their OCBC

Bank account. Payments through OCBC Pay Anyone have increased exponentially

with a tenfold increase in the amounts paid and almost fourfold increase in average monthly transactions since last year.

2017 – OCBC Bank has launched

its first standalone mobile payments app which makes QR code cashless payments

available at close to 2,500 NETS terminals. The new standalone OCBC Pay Anyone

app brings together all OCBC Pay Anyone services and enhancements – peer-to-peer

e-payments, QR code payments and access to OCBC Pay Anyone integrated with

Apple iPhone’s Siri and iMessage – into a fast and easy one-stop access to

e-payments. With the app, customers can simply scan QR codes at participating

merchants’ NETS terminals to pay for their purchases directly from their OCBC

Bank account. Payments through OCBC Pay Anyone have increased exponentially

with a tenfold increase in the amounts paid and almost fourfold increase in average monthly transactions since last year.

The OCBC Pay Anyone app is available for download on the Apple and Google Play mobile app stores. From 1 June 2017, an OCBC Bank customer can pay for purchases at more than 1,000 merchants (from Robinsons to Zara, Marks & Spencer, Gap, Paradise Classic restaurants, Caltex stations and Gardens by the Bay) by scanning the QR codes on the NETS terminal or printed receipt using the OCBC Pay Anyone app. After authenticating the transaction securely with a fingerprint, the payment is immediately deducted from the customer’s OCBC Bank account and paid to the merchant through NETS. This is unlike mobile wallets which require additional steps to top up the mobile wallet using a bank account. By the end of the year, customers will be able to make QR code payments at more than 50,000 NETS terminals island wide.

Mr Pranav Seth, OCBC Bank’s Head of E-Business, Business Transformation and Fintech and Innovation Group, said: “It’s a war on cash! OCBC Pay Anyone has been a favourite payment service among our customers, who have embraced the movement away from cash and increasingly adopted paying other individuals using just phone numbers. OCBC Pay Anyone payment volumes have increased 10 times since May last year. Now, we want to bring the same convenience to paying for your regular shopping and meals using QR codes, so we decided to consolidate all of our OCBC Pay Anyone payment services into a standalone mobile app to bring greater convenience to our customers.

“The launch of QR code cashless payment adds to the suite of OCBC Pay Anyone e-payment services. I believe the pick-up of QR code cashless payments will be strong given the increasing acceptance rate of cashless payments in general over the years. We will continue to push the boundaries in mobile payments and move the needle in becoming a cashless society. We are excited about the new and varied cashless payment options that we will roll out on the OCBC Pay Anyone app.”

OCBC Bank customers get a $10 rebate for first-time QR code payments

From 1 June to 30 June, all OCBC Bank customers can enjoy one $10 rebate when they make their first QR code payment using the OCBC Pay Anyone app at Robinsons, Marks & Spencer, Paradise Classic restaurants or Caltex stations.

Customers simply need to download the OCBC Pay Anyone app, perform the one-time setup and make a purchase of any amount by scanning the QR code on a NETS terminal at Robinsons, Marks & Spencer, Paradise Classic restaurants or Caltex stations. The $10 cash rebate will be credited to the customer’s account in July.

Making a QR code payment with OCBC Pay Anyone

Once the OCBC Pay Anyone app has been downloaded, customers need to perform a one-time setup to enable payments via the app.

– To perform the one-time setup:

– Click “Get Started” and tick the box to agree to the app’s terms and conditions

– Key in online banking access code and PIN

– Enter the one-time password sent to your mobile device and click “submit”

– A message will be displayed indicating the successful setup

– Click “Next” to proceed with QR code payments

QR code payments are available on Apple iPhone devices running iOS8 and above, and Samsung devices running on Android 4.4 Kit Kat with the fingerprint recognition feature.

To make a payment at a participating merchant, customers simply open the OCBC Pay Anyone app, scan the QR code on the merchant’s NETS point-of-sale terminal or on the printed NETS terminal receipt and authenticate the transaction using their fingerprint. The app will prompt the customer to choose the OCBC Bank account to pay from. Once the bank account has been selected, customers click “pay now” to complete the transaction.

1. Scan the QR code on the NETS point-of-sale terminal or on the printed NETS receipt. Authenticate transaction with fingerprint.

2. Select OCBC Bank account to pay from, and click ‘Pay Now’.

3. A successful transaction message will be shown once payment is complete.

Evolution of OCBC Pay Anyone

Launched in 2014, OCBC Pay Anyone is the only mobile payment service offered in Singapore that lets customers send money directly to any bank account in Singapore using just the recipient’s mobile number, email address or Facebook account – without having to perform transaction signing using a security token or to add the recipient as a “payee”.

In September 2016, the daily transfer limit on OCBC Pay Anyone was increased from $100 to $1,000, bringing greater convenience to customers and allowing payments for bigger-ticket items. The average transaction amounts since then grew three-fold. In October 2016, OCBC Bank further enhanced OCBC Pay Anyone by enabling transactions using Apple’s Siri voice command feature and directly within iMessage.

The number of e-payments performed grew fourfold, and the amounts paid grew tenfold, from a year ago. Seventy per cent of OCBC Pay Anyone users are aged between 16 and 29. OCBC Bank’s market penetration among youths and young adults continues to deepen, with one in every two members of this segment an OCBC Bank customer. The growing popularity of OCBC Pay Anyone requires OCBC Bank to continue innovating so that this e-payment service can deliver beyond the demands of its customers.

QR code payments are the next phase of mobile contactless payments that OCBC Bank has embraced. The new OCBC Pay Anyone app will no doubt make payments even more convenient and accessible for customers.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!