New CA Technologies Payment Security Solution Reduces Online Fraud Loss

by 25 Percent

by 25 Percent

CA Applies Real-Time Behavioral Analytics and Machine

Learning to Largest Pool of Online Transaction Data to Stop Fraud Instantly

Learning to Largest Pool of Online Transaction Data to Stop Fraud Instantly

Singapore – May 5, 2017 – CA Technologies (NASDAQ:CA) today announced CA Risk Analytics Network,

the payment industry’s only card-issuer network that stops card-not-present

fraud instantly for network members using real-time behavior analytics, machine

learning and global transaction data to reduce online fraud losses by an

average of 25 percent* – a potential of US$2.2 billion in savings.**

the payment industry’s only card-issuer network that stops card-not-present

fraud instantly for network members using real-time behavior analytics, machine

learning and global transaction data to reduce online fraud losses by an

average of 25 percent* – a potential of US$2.2 billion in savings.**

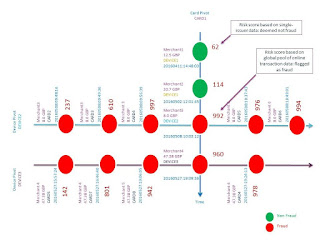

As a cloud-based service, CA Risk Analytics Network incorporates a new

advanced neural network model, backed by real-time machine learning, to protect 3-D Secure card-not-present (CNP) transactions. It learns from, and

adapts to, suspected fraudulent transactions in an average of five

milliseconds, instantly closing the gap for potential fraud using the same card

or device across all members of the network.

advanced neural network model, backed by real-time machine learning, to protect 3-D Secure card-not-present (CNP) transactions. It learns from, and

adapts to, suspected fraudulent transactions in an average of five

milliseconds, instantly closing the gap for potential fraud using the same card

or device across all members of the network.

According to Javelin’s 2017 Identity Fraud Report, explosive growth in

card-not-present fraud, driven by the increasing e-commerce and m-commerce

volume, as well as theEMV liability shift,

contributed to the rise of existing-card fraud. “Just as e-commerce is

displacing point-of-sale transactions, the same is true for the channels in

which fraudsters choose to conduct their business. Among consumers, there was a

42 percent increase in those who had their cards misused in a CNP transaction

in 2016, compared to 2015 levels,” the report showed.

card-not-present fraud, driven by the increasing e-commerce and m-commerce

volume, as well as theEMV liability shift,

contributed to the rise of existing-card fraud. “Just as e-commerce is

displacing point-of-sale transactions, the same is true for the channels in

which fraudsters choose to conduct their business. Among consumers, there was a

42 percent increase in those who had their cards misused in a CNP transaction

in 2016, compared to 2015 levels,” the report showed.

“Detecting anomalies quickly and ensuring frictionless authentication

are the first steps in preventing card-not-present fraud without impacting

legitimate cardholder transactions,” said Terrence Clark, general manager for

CA Technologies Payment Security solutions. “Our data scientists have applied

advanced analytics and new, real-time, machine learning algorithms to the

global pool of 3-D Secure, e-commerce transaction data and device insights

maintained by the CA Payment Security Suite. This provides faster and more

accurate online fraud detection and prevention, reducing fraud losses for

network members while streamlining online shopping experiences for consumers.”

are the first steps in preventing card-not-present fraud without impacting

legitimate cardholder transactions,” said Terrence Clark, general manager for

CA Technologies Payment Security solutions. “Our data scientists have applied

advanced analytics and new, real-time, machine learning algorithms to the

global pool of 3-D Secure, e-commerce transaction data and device insights

maintained by the CA Payment Security Suite. This provides faster and more

accurate online fraud detection and prevention, reducing fraud losses for

network members while streamlining online shopping experiences for consumers.”

CA’s payment security solutions protect billions of online transactions

supporting hundreds of millions of cards and thousands of card portfolios

worldwide. CA Risk Analytics Network is open to card issuers with portfolios of

any size: from global banks with millions of cardholders, to smaller, or

regional financial institutions.

supporting hundreds of millions of cards and thousands of card portfolios

worldwide. CA Risk Analytics Network is open to card issuers with portfolios of

any size: from global banks with millions of cardholders, to smaller, or

regional financial institutions.

Support for

3-D Secure protocols today and in the future

3-D Secure protocols today and in the future

CA Risk Analytics Network and the CA Payment Security Suite support the 3-D

Secure specification today, and will support the new EMV 3-D Secure 2.0 specification, which addresses

authentication and security for card-not-present, e-commerce transactions using

smart phones, mobile apps, digital wallets and other forms of digital payment.

The 2.0 protocol will make extensive use of device data, giving CA Risk Analytics

Network subscribers a growing new source of information to reduce fraud and

optimize the customer experience across all consumer shopping devices and all

versions of the 3-D Secure protocol. Support for both the 1.0 and 2.0

specifications is important as adoption rates of the updated specification

among card issuers and merchants will vary.

Secure specification today, and will support the new EMV 3-D Secure 2.0 specification, which addresses

authentication and security for card-not-present, e-commerce transactions using

smart phones, mobile apps, digital wallets and other forms of digital payment.

The 2.0 protocol will make extensive use of device data, giving CA Risk Analytics

Network subscribers a growing new source of information to reduce fraud and

optimize the customer experience across all consumer shopping devices and all

versions of the 3-D Secure protocol. Support for both the 1.0 and 2.0

specifications is important as adoption rates of the updated specification

among card issuers and merchants will vary.

Resources

*Data based on applying the new CA Risk Analytics Network fraud model to

historical customer data over a 90-day period.

historical customer data over a 90-day period.

** Potential savings based on existing-card account fraud of US$8.8

billion in 2016, reported in “2017 Identity Fraud: Securing the Connected

Life,” a Javelin Strategy & Research survey conducted among 5,028 U.S.

adults over age 18.

billion in 2016, reported in “2017 Identity Fraud: Securing the Connected

Life,” a Javelin Strategy & Research survey conducted among 5,028 U.S.

adults over age 18.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!