With digital transformation forcing the entire world to get everyone involved with smart electronics and gadgets, market saturation continues to prove itself through the decline of PC sales even in Q1 2023.

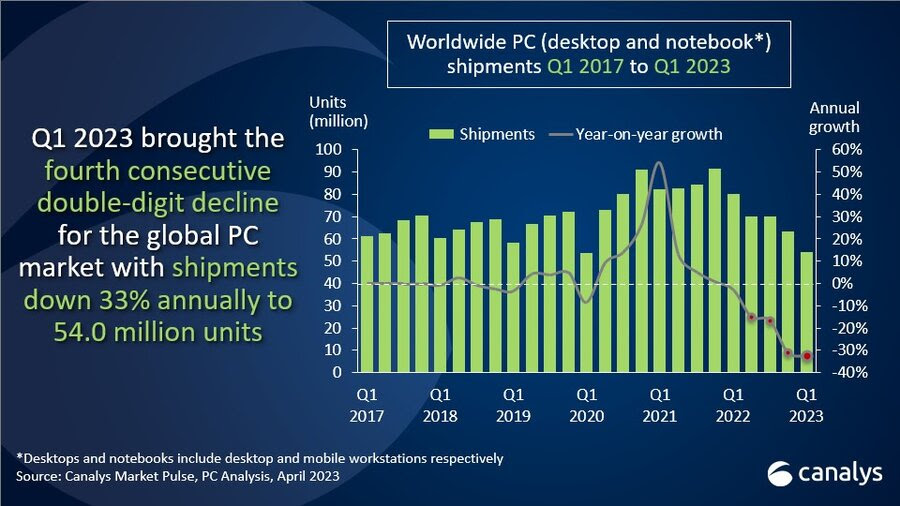

From the data, total shipments are down to just 54 million units – a 33% decline and the 4th consecutive quarter of double-digit annual declines. With inventory clearance as one of the key priorities, the end of 2022 extending into the 2023 new year has been a weak holiday season overall. The biggest loser here comes from notebooks with a 34% YoY fall to 41.8 million units while desktops faired better at 12.1 million units or a 28% decline.

From the data, total shipments are down to just 54 million units – a 33% decline and the 4th consecutive quarter of double-digit annual declines. With inventory clearance as one of the key priorities, the end of 2022 extending into the 2023 new year has been a weak holiday season overall. The biggest loser here comes from notebooks with a 34% YoY fall to 41.8 million units while desktops faired better at 12.1 million units or a 28% decline.

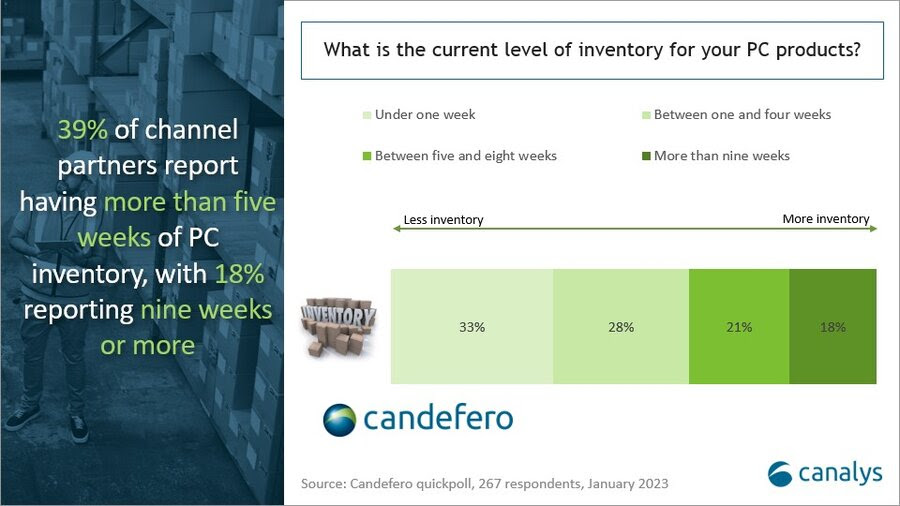

According to another research by Candefero, 39% of manufacturers stated they have stocks that are at least 5 weeks old while 18% reported 9 weeks and more. However, Canalys is expecting things to turn around from H2 2023 onwards and scale positively next year.

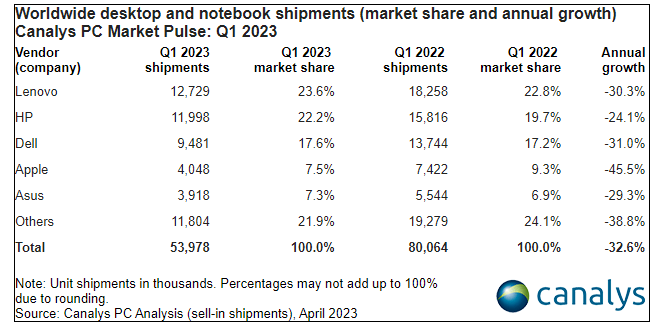

Looking from the aspect of vendors across the world, Lenovo is by far the largest loser here with an annual decline of 30% or down 12.7 million units with HP following suit at 24%/12 million units. 3rd place is taken by Dell at 31% / 9.5 million units and that’s the first time it hits the 10M mark since Q1 2018. The rest of the “leaderboard” is filled by April and ASUS takes the 4th and 5th place.

Looking from the aspect of vendors across the world, Lenovo is by far the largest loser here with an annual decline of 30% or down 12.7 million units with HP following suit at 24%/12 million units. 3rd place is taken by Dell at 31% / 9.5 million units and that’s the first time it hits the 10M mark since Q1 2018. The rest of the “leaderboard” is filled by April and ASUS takes the 4th and 5th place.