As the world grows more digital day by day, people are increasingly turning to apps and solutions that help to make their lives more seamless and convenient, with digital payments being one of them. According to the e-Conomy SEA Report 2020, there has been an 11% decline in cash transactions between the period pre- and post-COVID-19 as more people turn to digital payments as their preferred way to pay.

With most retail stores offering online shopping this festive season, many Singaporeans are expecting to take their holiday shopping digital. Google Pay is designed to provide users with a simple and helpful way to pay, while safeguarding their privacy and security. Here are five ways Google Pay makes payments safer:

|

[NEW] A personalized offers and rewards experience that’s completely opt-in. Starting today, Google Pay’s improved privacy controls will provide you with the option of personalizing your experience within the app. The setting is turned off by default and you can choose to turn this on or off anytime, giving you control of what information is used and how. If you choose to turn on this feature in the Google Pay app, you may see offers that help you earn rewards with your favorite merchants. For example, if you often dine in a restaurant and pay with Google Pay then you might see more offers that help you earn rewards on those payments.

|

|

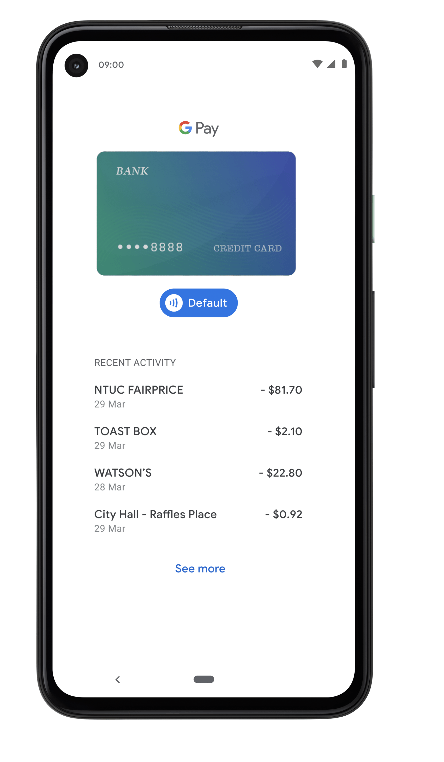

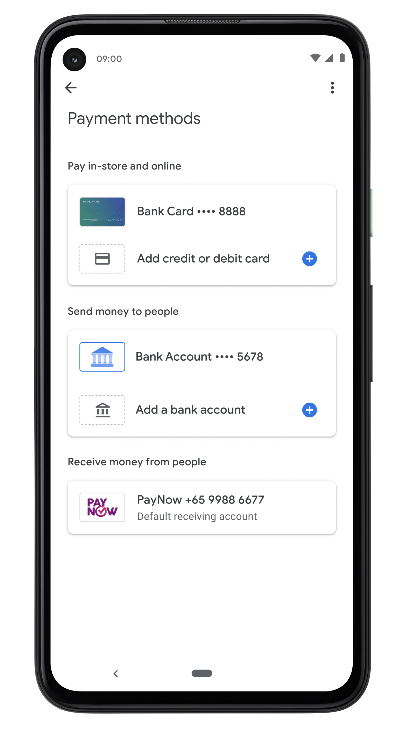

A unique code, instead of your credit card number When you tap to pay with your Android phone, Google Pay shares a unique Virtual Account Number instead of your actual card number with the business, so your payment info stays safe. Using virtual account numbers ensures that your card number is not exposed to hackers or thieves and your transactions are safe.

|

|

Your data is securely stored and encrypted Payment methods saved to your Google Account are securely stored on Google’s private servers. When you pay online, Google Pay encrypts your data so your payment stays safe on the way to the business.

|

|

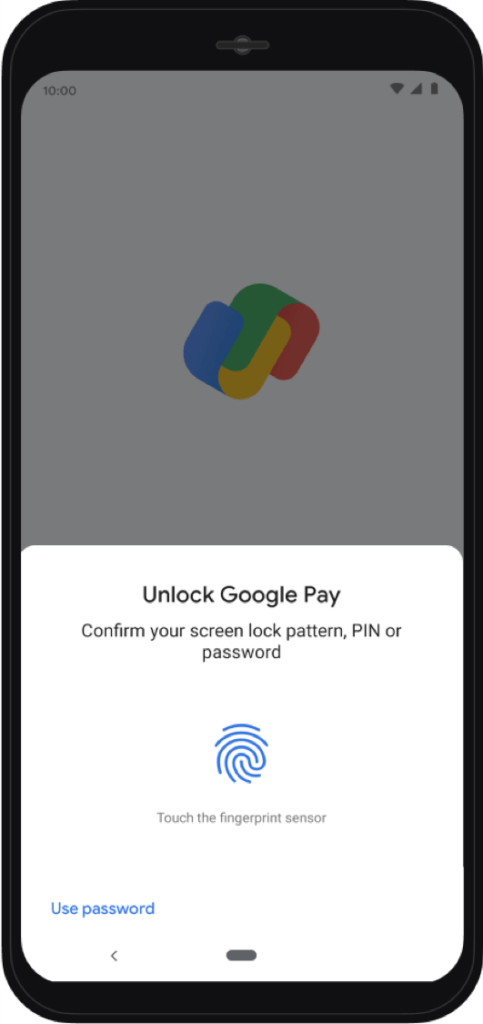

Authentication each time you launch the app You’ll need to unlock with your fingerprint, pattern, PIN, or face each time you open Google Pay, so no one can make payments or send money but you.

Deactivate GPay when you lose your mobile phone If you ever lose your Android phone, you can use Google’s Find My Device to disable your digital wallet remotely. If you lose your iPhone, you can Erase your device to wipe information off your phone. Disabling the app does not delete your stored Google Pay data so you can reinstall the app and still have the information you opted to keep. |

In the first half of 2020, the Singapore Police Force recorded almost a 140 per cent jump in scam cases in its top 10 scam categories compared to the same period last year, amounting to a total of $82 million lost by victims. With bad actors always looking for ways to gain a hold of our personal and financial information, using a secure payment app like Google Pay is one of the ways we can shore up our defences and keep our data safe. More importantly, Google Pay does not sell transaction history to third parties or share it with the rest of Google for targeting ads.