Mobile

robotics: thinking in terms of fleet productivity is key to success

robotics: thinking in terms of fleet productivity is key to success

Autonomous

mobile robots are causing a paradigm shift in the way we envisage commercial

and industrial vehicles. In traditional thinking bigger is often better. This

is because bigger vehicles are faster and are thus more productive. This

thinking holds true so long as each vehicle requires a human driver. The rise

of autonomous mobility is however upending this long-established notion: fleets

of small slow robots will replace or complement large fast manned

vehicles.

mobile robots are causing a paradigm shift in the way we envisage commercial

and industrial vehicles. In traditional thinking bigger is often better. This

is because bigger vehicles are faster and are thus more productive. This

thinking holds true so long as each vehicle requires a human driver. The rise

of autonomous mobility is however upending this long-established notion: fleets

of small slow robots will replace or complement large fast manned

vehicles.

In this

article, we will explore the basis and the future implications of this major

transition. We will focus on two applications in particular: agriculture and

last mile delivery. For both, we will demonstrate how autonomous

mobile robots have already begun this transformation.

article, we will explore the basis and the future implications of this major

transition. We will focus on two applications in particular: agriculture and

last mile delivery. For both, we will demonstrate how autonomous

mobile robots have already begun this transformation.

In this

article we draw from two of our recent studies: Agricultural Robots and Drones

2017-2027: Technologies, Markets, Players;

andMobile Robots and Drones in

Material Handling and Logistics 2017-2037. These

detailed reports offer a comprehensive technology and market assessment,

considering how robots and drones are penetrating into agriculture,

logistics and material handling.

article we draw from two of our recent studies: Agricultural Robots and Drones

2017-2027: Technologies, Markets, Players;

andMobile Robots and Drones in

Material Handling and Logistics 2017-2037. These

detailed reports offer a comprehensive technology and market assessment,

considering how robots and drones are penetrating into agriculture,

logistics and material handling.

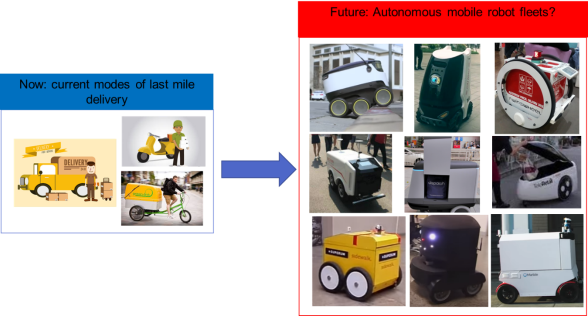

Last mile delivery vehicles: now and the future

Last

mile delivery remains an expensive affair, often representing more than half of

the total delivery cost. This is because it is inherently a

low productivity process: small parcels must be delivered to custom

destinations. This is in stark contrast to long haulage in which large

loads are transported along fixed routes.

mile delivery remains an expensive affair, often representing more than half of

the total delivery cost. This is because it is inherently a

low productivity process: small parcels must be delivered to custom

destinations. This is in stark contrast to long haulage in which large

loads are transported along fixed routes.

The

current modes of last mile delivery all involve humans: a driver may drive a

van along local routes, dropping parcels door by door; a person on a motorbike

or cycle may carry one or few items to limited destinations per run; or both.

These modes work and may be fast, but remain expensive despite

employing many new business models and route-optimization algorithms.

current modes of last mile delivery all involve humans: a driver may drive a

van along local routes, dropping parcels door by door; a person on a motorbike

or cycle may carry one or few items to limited destinations per run; or both.

These modes work and may be fast, but remain expensive despite

employing many new business models and route-optimization algorithms.

Change

is however underway, and we can already see the silhouette of the medium-term

future: unmanned autonomous robots carrying small loads to pre-determined

destinations. These robots may at first seem like strange creatures:

they are smaller and slower than current modes of last mile delivery and can

carry fewer items per trip, certainly making them less productive and thus less

cost effective.

is however underway, and we can already see the silhouette of the medium-term

future: unmanned autonomous robots carrying small loads to pre-determined

destinations. These robots may at first seem like strange creatures:

they are smaller and slower than current modes of last mile delivery and can

carry fewer items per trip, certainly making them less productive and thus less

cost effective.

Fleets

of autonomous last mile delivery robots have the potential to ultimately boost

the productivity in last mile delivery, thus reducing costs. Sources for

robots: first row: Starship Technologies, Alibaba,

and TwinWheel; second row: DJ, Dispatch, and Teleretail; and third

row: SideWak,, Marathon Technologies, and Marble

of autonomous last mile delivery robots have the potential to ultimately boost

the productivity in last mile delivery, thus reducing costs. Sources for

robots: first row: Starship Technologies, Alibaba,

and TwinWheel; second row: DJ, Dispatch, and Teleretail; and third

row: SideWak,, Marathon Technologies, and Marble

However,

this is old thinking in which productivity is compared on a per unit

basis. This is because autonomous mobility lends itself to fleet operation. In

this model, one remote operator may monitor and control the work of many

delivery robots. In this case, the wage and overhead of the person is spread

over many robots. In essence, the fleet will magnify the productivity of the

operator.Consequently, productivity must be compared at level of the fleet.

this is old thinking in which productivity is compared on a per unit

basis. This is because autonomous mobility lends itself to fleet operation. In

this model, one remote operator may monitor and control the work of many

delivery robots. In this case, the wage and overhead of the person is spread

over many robots. In essence, the fleet will magnify the productivity of the

operator.Consequently, productivity must be compared at level of the fleet.

In our

report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037, we

have built a model looking at the cost competitiveness of last mile delivery

robots. We estimate the operator-to-fleet-size ratio at which

mobile robots become more competitive than a man on a bike. This threshold

is difficult to achieve given the current retail prices for early adopters of

this robottechnology.

report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037, we

have built a model looking at the cost competitiveness of last mile delivery

robots. We estimate the operator-to-fleet-size ratio at which

mobile robots become more competitive than a man on a bike. This threshold

is difficult to achieve given the current retail prices for early adopters of

this robottechnology.

Our

roadmap suggests that this threshold become very achievable in the

near future. This is because these mobile robots currently travel at low speeds

along well-structured and uncrowded routes performing short delivery runs.

In the future, as these robots learn more, they will become better adapt at

navigating more complex environments at higher speeds with less

supervision, thus boosting the productivity of individual units.

roadmap suggests that this threshold become very achievable in the

near future. This is because these mobile robots currently travel at low speeds

along well-structured and uncrowded routes performing short delivery runs.

In the future, as these robots learn more, they will become better adapt at

navigating more complex environments at higher speeds with less

supervision, thus boosting the productivity of individual units.

Furthermore, we expect

the cost to fall dramatically in the near term. These robots do not

require complex hardware. In fact, they are not too dissimilar to an electric

scooter integrated with a mobile phone. Indeed, we expect the hardware platform

to become commoditized in the future, and the primary value to shift towards

fleet management and delivery services. This explains why some in this business

are already self-positioning as providers of robots-as-a-service (RaaS).

the cost to fall dramatically in the near term. These robots do not

require complex hardware. In fact, they are not too dissimilar to an electric

scooter integrated with a mobile phone. Indeed, we expect the hardware platform

to become commoditized in the future, and the primary value to shift towards

fleet management and delivery services. This explains why some in this business

are already self-positioning as providers of robots-as-a-service (RaaS).

The

forecasts in our report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037 suggest

that the sales of ground-based last mile delivery

robots will be modest until 2021-23. In

this early phase the industry is essentially in learning

mode and the activity will be limited to trials or modest sales

for use in sparse and highly-structured environments.

The growth phase will then commence. In this phase, the robots

will also become increasingly ready to handle more crowded environments and

their speed of travel and navigational technology

will significantly improve. The unit sales

boom and the hardware product will become

commoditized. This way we will witness the rise of fleets of

small-sized last mile delivery robots.

forecasts in our report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037 suggest

that the sales of ground-based last mile delivery

robots will be modest until 2021-23. In

this early phase the industry is essentially in learning

mode and the activity will be limited to trials or modest sales

for use in sparse and highly-structured environments.

The growth phase will then commence. In this phase, the robots

will also become increasingly ready to handle more crowded environments and

their speed of travel and navigational technology

will significantly improve. The unit sales

boom and the hardware product will become

commoditized. This way we will witness the rise of fleets of

small-sized last mile delivery robots.

For

further information please refer to our report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037.This

report provides a comprehensive assessment of robots and drones in material

handling and logistics. It considers many uses cases beyond last mile

delivery robots including automated guided vehicles/carts; autonomous

industrial material handling vehicles, autonomous mobile carts, autonomous

mobile picking robots, and autonomous trucks

further information please refer to our report Mobile Robots and Drones in

Material Handling and Logistics 2017-2037.This

report provides a comprehensive assessment of robots and drones in material

handling and logistics. It considers many uses cases beyond last mile

delivery robots including automated guided vehicles/carts; autonomous

industrial material handling vehicles, autonomous mobile carts, autonomous

mobile picking robots, and autonomous trucks

Agricultural vehicles: now and the future

The

traditional thinking is to develop larger, faster and more powerful

agricultural vehicles like mammoth tractors to boost productivity.

This has been sound thinking thus far: such vehicles amplify the productivity

of the driver, enabling it to cover more ground per hour in a limited time

window that the weather might permit.

traditional thinking is to develop larger, faster and more powerful

agricultural vehicles like mammoth tractors to boost productivity.

This has been sound thinking thus far: such vehicles amplify the productivity

of the driver, enabling it to cover more ground per hour in a limited time

window that the weather might permit.

As

discussed in our report Agricultural Robots and Drones

2017-2027: Technologies, Markets, Players, agriculture

is the leading adopter of autonomous mobile technology: we estimate that more

320,000 autosteer and auto-guidance tractors will be sold in 2018 (up

to level 4 autonomy). The technology is already evolving towards full navigational

autonomy (level 5). Indeed, as the numerous prototypes demonstrates the

commercialization emphasis has shifted from addressing technical issues towards

tackling commercial and behavioural challenges.

discussed in our report Agricultural Robots and Drones

2017-2027: Technologies, Markets, Players, agriculture

is the leading adopter of autonomous mobile technology: we estimate that more

320,000 autosteer and auto-guidance tractors will be sold in 2018 (up

to level 4 autonomy). The technology is already evolving towards full navigational

autonomy (level 5). Indeed, as the numerous prototypes demonstrates the

commercialization emphasis has shifted from addressing technical issues towards

tackling commercial and behavioural challenges.

The

rise of autonomous mobility may also enable another type of agricultural

vehicle that might also at first seem like a strange creature: the

small, slow and lightweight agricultural robot (agrobot). These robots are

evidently less productive than a larger vehicletherefore you might wonder

why are they being seriously considered by players large and small around the

world?

rise of autonomous mobility may also enable another type of agricultural

vehicle that might also at first seem like a strange creature: the

small, slow and lightweight agricultural robot (agrobot). These robots are

evidently less productive than a larger vehicletherefore you might wonder

why are they being seriously considered by players large and small around the

world?

The

seeds of a paradigm shift in the way we envisage agriculture machinery have

been sown. In this shift few large, heavy, and fast vehicles are

replaced with large fleets of small, slow and light weight agrobots. Images

source for agrobots: first column: FENDT; Queensland

University; Naio Technologies, Australia Centre of Field Robotics,

and ecoRobotix; second column: Earthsense, Idaho, andKongskilde; and

third column: Rowbot, Ibex Automation, and Vinerobot

seeds of a paradigm shift in the way we envisage agriculture machinery have

been sown. In this shift few large, heavy, and fast vehicles are

replaced with large fleets of small, slow and light weight agrobots. Images

source for agrobots: first column: FENDT; Queensland

University; Naio Technologies, Australia Centre of Field Robotics,

and ecoRobotix; second column: Earthsense, Idaho, andKongskilde; and

third column: Rowbot, Ibex Automation, and Vinerobot

The

answer here, as was the case in last mile delivery robots, is in fleet

operation. Autonomous mobility eliminates the need for a human driver per

vehicle, enabling the cost of the remote operator to be spread across the

fleet. This instantly lowers the operational cost per unmanned robot. As was

the case with last mile delivery robots, here we also find that

achievable operator-to-fleet-size ratios exist at which fleets of small

agrobots become attractive.

answer here, as was the case in last mile delivery robots, is in fleet

operation. Autonomous mobility eliminates the need for a human driver per

vehicle, enabling the cost of the remote operator to be spread across the

fleet. This instantly lowers the operational cost per unmanned robot. As was

the case with last mile delivery robots, here we also find that

achievable operator-to-fleet-size ratios exist at which fleets of small

agrobots become attractive.

This

alone however may not be compelling enough since large tractors will also

become autonomous, lending themselves to fleet operation. Such fleets

will reduce the headcount, cut down the wage bill incurred in farming and

open the door to limited precision farming.

alone however may not be compelling enough since large tractors will also

become autonomous, lending themselves to fleet operation. Such fleets

will reduce the headcount, cut down the wage bill incurred in farming and

open the door to limited precision farming.

Fleets

of small agrobots will go further in that they will enable

site-specific or even plant-specific ultraprecision farming. These

slow-moving robots will give each site the customized attention that it needs

all the way from planting to harvesting. This would be

akin toindustrialized gardening. This will boost yields and will also

significantly reduce chemical use. Furthermore, these light robots will cause

no soil compaction and will drive down energy

consumption, emitting no noise and CO2 since they are electrically

powered.

of small agrobots will go further in that they will enable

site-specific or even plant-specific ultraprecision farming. These

slow-moving robots will give each site the customized attention that it needs

all the way from planting to harvesting. This would be

akin toindustrialized gardening. This will boost yields and will also

significantly reduce chemical use. Furthermore, these light robots will cause

no soil compaction and will drive down energy

consumption, emitting no noise and CO2 since they are electrically

powered.

Here

too we are also at the beginning of the journey. We also see numerous such

robots developed at start-ups and research entities. We are also witnessing more

engagement from larger firms with some promising to take such robot swarms

towards full production. This is why our report forecasts that autonomous

small mobile robots will grow to more than $500M annual sales in 2028.

too we are also at the beginning of the journey. We also see numerous such

robots developed at start-ups and research entities. We are also witnessing more

engagement from larger firms with some promising to take such robot swarms

towards full production. This is why our report forecasts that autonomous

small mobile robots will grow to more than $500M annual sales in 2028.

For further information please refer to our report Agricultural Robots and Drones

2017-2027: Technologies, Markets, Players. Thisreport develops

a detailed roadmap of how robotic technology will enter into different aspects

of agriculture and how it will change the way farming is done. It

will consider many applications and technologies including static milking

robotics, mobile dairy farm robots, autosteer tractors, autonomous tractors,

unmanned spraying drones, autonomous data mapping drones, robotic implements

for de-weeding, autonomous de-weeding mobile robots, robotic fresh fruit

harvesting, robotic strawberry harvesting, manned and unmanned robotic

lettuce/vegetable thinning/harvesting and so on.

2017-2027: Technologies, Markets, Players. Thisreport develops

a detailed roadmap of how robotic technology will enter into different aspects

of agriculture and how it will change the way farming is done. It

will consider many applications and technologies including static milking

robotics, mobile dairy farm robots, autosteer tractors, autonomous tractors,

unmanned spraying drones, autonomous data mapping drones, robotic implements

for de-weeding, autonomous de-weeding mobile robots, robotic fresh fruit

harvesting, robotic strawberry harvesting, manned and unmanned robotic

lettuce/vegetable thinning/harvesting and so on.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!