OCBC

BANK MAKES PAYNOW EVEN MORE SEAMLESS BY ENABLING ACCOUNT-TO-ACCOUNT QR CODE

FUNDS TRANSFERS

BANK MAKES PAYNOW EVEN MORE SEAMLESS BY ENABLING ACCOUNT-TO-ACCOUNT QR CODE

FUNDS TRANSFERS

OCBC Pay Anyone App

enables customers to send and ask for money using QR codes, so parties do not

even need to share mobile or NRIC numbers

enables customers to send and ask for money using QR codes, so parties do not

even need to share mobile or NRIC numbers

PayNow just got better: QR code e-payments

do not require parties to share mobile or NRIC numbers

do not require parties to share mobile or NRIC numbers

Singapore, 18

July 2017 –

By innovatively marrying QR codes with PayNow’s infrastructure, OCBC Bank has

delivered a new level of convenience to funds transfers.

July 2017 –

By innovatively marrying QR codes with PayNow’s infrastructure, OCBC Bank has

delivered a new level of convenience to funds transfers.

PayNow did away with

the need to know bank account numbers and “adding payees” when making funds

transfers. The OCBC Pay Anyone app enables customers to send and ask for money

using QR codes, so that there is no need to even share mobile phone or NRIC

numbers. The transfers are made directly from the payer’s account to the

payee’s account: Unlike with some mobile wallets, no additional steps are

required to top up the wallet using a bank account, or transfer funds from a

wallet to a bank account.

the need to know bank account numbers and “adding payees” when making funds

transfers. The OCBC Pay Anyone app enables customers to send and ask for money

using QR codes, so that there is no need to even share mobile phone or NRIC

numbers. The transfers are made directly from the payer’s account to the

payee’s account: Unlike with some mobile wallets, no additional steps are

required to top up the wallet using a bank account, or transfer funds from a

wallet to a bank account.

PayNow-registered

customers, through the OCBC Pay Anyone mobile app, can now create and send

personalised QR codes to other OCBC Pay Anyone users via social networking apps

or email when requesting payment. Alternatively, the payer can instantly scan a

QR code displayed on the payee’s phone to complete payment. The daily transfer

limit for payers is $1,000.

customers, through the OCBC Pay Anyone mobile app, can now create and send

personalised QR codes to other OCBC Pay Anyone users via social networking apps

or email when requesting payment. Alternatively, the payer can instantly scan a

QR code displayed on the payee’s phone to complete payment. The daily transfer

limit for payers is $1,000.

QR code payments via

the OCBC Pay Anyone app are completely seamless and frictionless as

authentication is very quick, using just the payee’s and payer’s fingerprints.

There is no need to exchange mobile or NRIC numbers which is a boon for

peer-to-peer e-commerce, where sellers and buyers may not want to exchange

personal information but would just meet up to make payment and hand over the

goods. Payees can now simply create a QR code, which would specify the amount

to be paid, and send it via the e-commerce platform or social media for the

payer to scan and pay. Alternatively, a payee can meet the payer and have the

latter scan the QR code directly on a mobile device to make immediate payment.

the OCBC Pay Anyone app are completely seamless and frictionless as

authentication is very quick, using just the payee’s and payer’s fingerprints.

There is no need to exchange mobile or NRIC numbers which is a boon for

peer-to-peer e-commerce, where sellers and buyers may not want to exchange

personal information but would just meet up to make payment and hand over the

goods. Payees can now simply create a QR code, which would specify the amount

to be paid, and send it via the e-commerce platform or social media for the

payer to scan and pay. Alternatively, a payee can meet the payer and have the

latter scan the QR code directly on a mobile device to make immediate payment.

With this latest QR

code innovation, OCBC Bank is further accelerating the adoption of PayNow.

Since PayNow was launched on 10 July, close to 100,000 people have linked their

mobile or NRIC numbers to their personal OCBC Bank account to facilitate

instant account-to-account transfers via FAST. These 100,000 PayNow subscribers

will now have the additional option of making peer-to-peer payments via QR code

using the OCBC Pay Anyone app.

code innovation, OCBC Bank is further accelerating the adoption of PayNow.

Since PayNow was launched on 10 July, close to 100,000 people have linked their

mobile or NRIC numbers to their personal OCBC Bank account to facilitate

instant account-to-account transfers via FAST. These 100,000 PayNow subscribers

will now have the additional option of making peer-to-peer payments via QR code

using the OCBC Pay Anyone app.

Peer-to-peer QR code

payment is the latest in a series of OCBC Pay Anyone enhancements rolled out in

the past months. Launched in 2014, OCBC Pay Anyone was the first mobile payment

service offered in Singapore that let customers send money directly to any bank

account in Singapore using just the recipient’s mobile number, email address or

Facebook account – without having to perform transaction signing using a

security token or to add the recipient as a “payee”. OCBC Bank launched a new

standalone OCBC Pay Anyone app in May this year, which has brought together all

OCBC Pay Anyone services and enhancements: Peer-to-peer QR code payments, QR

code payments to NETS merchants, peer-to-peer e-payments and integration of

OCBC Pay Anyone with Apple iPhone’s Siri and iMessage.

payment is the latest in a series of OCBC Pay Anyone enhancements rolled out in

the past months. Launched in 2014, OCBC Pay Anyone was the first mobile payment

service offered in Singapore that let customers send money directly to any bank

account in Singapore using just the recipient’s mobile number, email address or

Facebook account – without having to perform transaction signing using a

security token or to add the recipient as a “payee”. OCBC Bank launched a new

standalone OCBC Pay Anyone app in May this year, which has brought together all

OCBC Pay Anyone services and enhancements: Peer-to-peer QR code payments, QR

code payments to NETS merchants, peer-to-peer e-payments and integration of

OCBC Pay Anyone with Apple iPhone’s Siri and iMessage.

Mr Aditya Gupta, OCBC

Bank’s Head of E-Business Singapore, said: “Cashless is the new normal! With

OCBC Pay Anyone, our customers have been embracing the move away from cash as

they get the convenience of real-time payments of all types in one single app.

Be it peer-to-peer, in-store or online payment, customers can simply use QR

codes, mobile or NRIC numbers – or even Facebook – to pay via the OCBC Pay

Anyone app. We believe the recent launch of PayNow is an inflection point for

driving cashless payments behaviour in Singapore, and we have integrated that

with OCBC Pay Anyone to offer our customers the additional convenience of QR

code peer-to-peer payments. We will continue to push the boundaries on mobile

payments and move the needle in making Singapore a cashless society.”

Bank’s Head of E-Business Singapore, said: “Cashless is the new normal! With

OCBC Pay Anyone, our customers have been embracing the move away from cash as

they get the convenience of real-time payments of all types in one single app.

Be it peer-to-peer, in-store or online payment, customers can simply use QR

codes, mobile or NRIC numbers – or even Facebook – to pay via the OCBC Pay

Anyone app. We believe the recent launch of PayNow is an inflection point for

driving cashless payments behaviour in Singapore, and we have integrated that

with OCBC Pay Anyone to offer our customers the additional convenience of QR

code peer-to-peer payments. We will continue to push the boundaries on mobile

payments and move the needle in making Singapore a cashless society.”

Peer-to-peer QR code

payments are available to OCBC Bank customers who have registered for PayNow.

Customers need to use Apple iPhone devices running on iOS8 and above or Samsung

devices running on Android 4.4 Kit Kat, with the fingerprint recognition

feature.

payments are available to OCBC Bank customers who have registered for PayNow.

Customers need to use Apple iPhone devices running on iOS8 and above or Samsung

devices running on Android 4.4 Kit Kat, with the fingerprint recognition

feature.

OCBC Bank customers

stand to win up to S$50,000 in cash when they register for PayNow

stand to win up to S$50,000 in cash when they register for PayNow

From

10 July to 20 August 2017, OCBC Bank customers stand a chance of winning

cash prizes when they register for PayNow. Customers simply need to have an

OCBC Bank current or savings account, and go to OCBC Mobile Banking or Internet

Banking to link their accounts to their mobile or NRIC numbers.

10 July to 20 August 2017, OCBC Bank customers stand a chance of winning

cash prizes when they register for PayNow. Customers simply need to have an

OCBC Bank current or savings account, and go to OCBC Mobile Banking or Internet

Banking to link their accounts to their mobile or NRIC numbers.

There

are three grand lucky draw prizes that could be won by any customer who signs

up for PayNow between 10 July and 20 August. The grand lucky draw prizes

are $50,000, $30,000 and $10,000 in cash.

are three grand lucky draw prizes that could be won by any customer who signs

up for PayNow between 10 July and 20 August. The grand lucky draw prizes

are $50,000, $30,000 and $10,000 in cash.

For

six weeks until 20 August, 20 customers will each stand to win $500

in a weekly lucky draw. Customers who sign up for PayNow during a given week

will be eligible for the lucky draw for that week.

six weeks until 20 August, 20 customers will each stand to win $500

in a weekly lucky draw. Customers who sign up for PayNow during a given week

will be eligible for the lucky draw for that week.

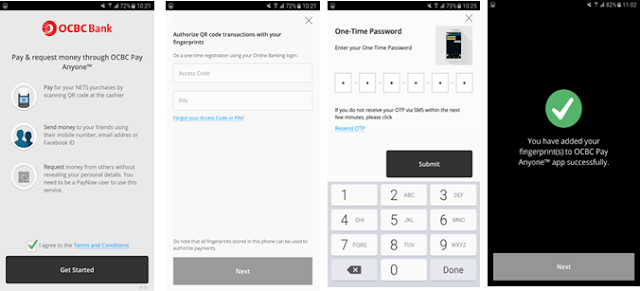

Getting

started on QR code payments on OCBC Pay Anyone app

started on QR code payments on OCBC Pay Anyone app

· Before you can access the QR code payment

service, there is a one-time set-up procedure that you must follow:

service, there is a one-time set-up procedure that you must follow:

· Click “Get Started” and tick the box to

agree to the app’s terms and conditions

agree to the app’s terms and conditions

· Key in your online banking access code and

PIN

PIN

· Enter the one-time password sent to your

mobile device and click “submit”

mobile device and click “submit”

· A message will be displayed indicating

that the set-up has been completed successfully

that the set-up has been completed successfully

· Click “Next” to proceed with QR code

payment

payment

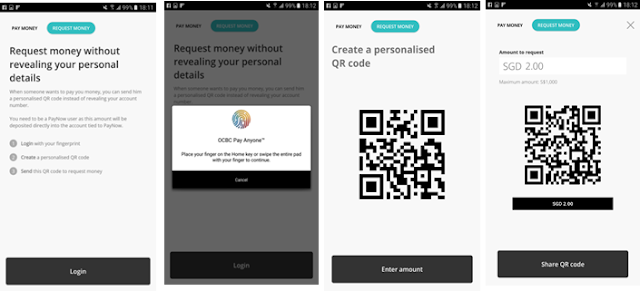

To

generate a personalised QR code to request payment:

generate a personalised QR code to request payment:

· Click the ‘request money’ tab

· Log in using your fingerprint

· Your personalised QR code is created

· Click ‘enter amount’ to indicate amount to

be paid

be paid

· Click ‘Share QR code’ to send the QR code

to others via social networking apps or email, or have the payer instantly scan

the QR code from your phone to make payment

to others via social networking apps or email, or have the payer instantly scan

the QR code from your phone to make payment

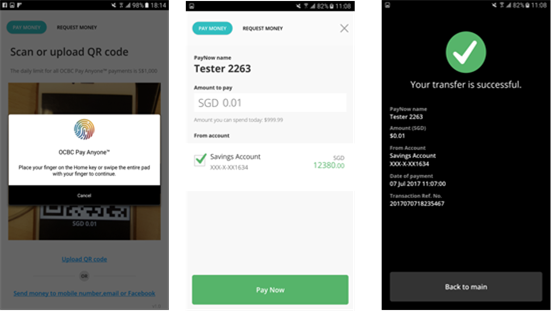

To

make a payment via QR code:

· Scan the QR code, or upload the QR code

from your phone gallery or photo album (if the recipient has sent it using a

social networking app or via email)

from your phone gallery or photo album (if the recipient has sent it using a

social networking app or via email)

· Authenticate the transaction with your

fingerprint

fingerprint

· Choose the bank account to pay from

· Click ‘Pay Now’

· Payment is instantly completed

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!