South Korean IT Display Manufacturers Replacing LCD with

OLED, IHS Markit Says

OLED, IHS Markit Says

LONDON (October 4, 2016) – Due to increasing capacity from

China, South Korean LCD panel makers are quickly realizing that LCD

displays profitability may eventually erode, due to growing capacity and

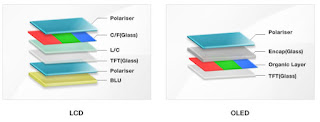

price competition from China, so they are betting their future on organic

light-emitting diode (OLED) displays. Because of lower profit margins and

slowing market growth, the IT display category has become the first product

line that LCD display manufacturers are quitting, according to IHS Markit

(Nasdaq: INFO), a world leader in critical information, analytics and

solutions.

China, South Korean LCD panel makers are quickly realizing that LCD

displays profitability may eventually erode, due to growing capacity and

price competition from China, so they are betting their future on organic

light-emitting diode (OLED) displays. Because of lower profit margins and

slowing market growth, the IT display category has become the first product

line that LCD display manufacturers are quitting, according to IHS Markit

(Nasdaq: INFO), a world leader in critical information, analytics and

solutions.

Samsung Display was the first company to do so, selling a fifth

generation (Gen 5) fabrication plant (fab) to a Chinese touch and module maker

last year. In the future, more fab restructuring is expected, especially

the facilities dedicated to making IT panels.

generation (Gen 5) fabrication plant (fab) to a Chinese touch and module maker

last year. In the future, more fab restructuring is expected, especially

the facilities dedicated to making IT panels.

“Brands like HP and Lenovo expected notebook panels to be in a

surplus situation, and they were therefore keeping their panel inventories at

very low levels,” said Jason Hsu, senior

principal analyst, IHS Markit. “This shift from Samsung Display

could cause some brands to experience panel shortages in the third quarter of

2016.”

surplus situation, and they were therefore keeping their panel inventories at

very low levels,” said Jason Hsu, senior

principal analyst, IHS Markit. “This shift from Samsung Display

could cause some brands to experience panel shortages in the third quarter of

2016.”

BOE to possibly double its panel shipments this year

Samsung Display delivered 30 million notebook panels in 2015,

according to the latest information from the IHS Markit Tablet

and Notebook Display Market Tracker. With the

company’s latest fab reorganization plan, notebook PC LCD panel shipments could

fall to 12 million units in 2016 and to 4 million in 2017. There will be an 18

million-unit gap this year, which means brands might not be able to find other

sources to keep up with production needs.

according to the latest information from the IHS Markit Tablet

and Notebook Display Market Tracker. With the

company’s latest fab reorganization plan, notebook PC LCD panel shipments could

fall to 12 million units in 2016 and to 4 million in 2017. There will be an 18

million-unit gap this year, which means brands might not be able to find other

sources to keep up with production needs.

When reviewing the supply chain mix in the first

quarter of 2016, it is clear that HP has been affected by these changes more

than other companies, with shipments from Samsung Display down from 1.1 million

units in first quarter to 350,000 units in the second quarter. However, HP has

shifted its orders to other panel makers to secure enough panels for itsproduction

needs, for example, Innolux.

quarter of 2016, it is clear that HP has been affected by these changes more

than other companies, with shipments from Samsung Display down from 1.1 million

units in first quarter to 350,000 units in the second quarter. However, HP has

shifted its orders to other panel makers to secure enough panels for itsproduction

needs, for example, Innolux.

BOE is another panel maker benefitting from the exit of Samsung

Display from this market. Panel shipments from BOE increased from 4.9 million

units in the first quarter to 7.2 million in the second quarter. BOE is

expected to grow itsnotebook business to more than 36 million units

in 2017. BOE first began to supply panels for notebooks in 2009, and ithas now become

one of the largest IT panel suppliers. Furthermore, BOE has a Gen8 fab

in Chongqing, China — near the world’s largest notebook production base.

In fact, notebook panel shipments from the Chongqing fab are expected to grow

quickly next year, thanks to the more efficient logistics.

Display from this market. Panel shipments from BOE increased from 4.9 million

units in the first quarter to 7.2 million in the second quarter. BOE is

expected to grow itsnotebook business to more than 36 million units

in 2017. BOE first began to supply panels for notebooks in 2009, and ithas now become

one of the largest IT panel suppliers. Furthermore, BOE has a Gen8 fab

in Chongqing, China — near the world’s largest notebook production base.

In fact, notebook panel shipments from the Chongqing fab are expected to grow

quickly next year, thanks to the more efficient logistics.

Chinese and Taiwanese makers to increase unit shipments of

premium panels

premium panels

LG Display and Samsung Display used to supply Apple with

notebook panels; however, the fab re-organization — especially the

reallocation of oxide capacity — has increased Apple’s concerns about a

potential panel shortage and possible low yields. For this reason, Apple

is expected to add another panel supplier for its new MacBook Pro, to diversify

the risk from Samsung Display business changes. For its legacy MacBook Air line

of notebook PCs, Apple is considering diversifying its supply chain to Chinese

makers, which is the first time Apple will use LCD panels from China.

notebook panels; however, the fab re-organization — especially the

reallocation of oxide capacity — has increased Apple’s concerns about a

potential panel shortage and possible low yields. For this reason, Apple

is expected to add another panel supplier for its new MacBook Pro, to diversify

the risk from Samsung Display business changes. For its legacy MacBook Air line

of notebook PCs, Apple is considering diversifying its supply chain to Chinese

makers, which is the first time Apple will use LCD panels from China.

Samsung Display’s exit from the LCD display business has also

affected the supply of wide-view-angle in-plane switching (IPS) and

plane-to-line switching (PLS) displays. Samsung Display has been one of the

major suppliers to offer wide-view-angle panels, and its shipment volume is

second only to LG Display.

affected the supply of wide-view-angle in-plane switching (IPS) and

plane-to-line switching (PLS) displays. Samsung Display has been one of the

major suppliers to offer wide-view-angle panels, and its shipment volume is

second only to LG Display.

In order to source IPS and PLS panels, brands must

find other sources to replace Samsung Display, after the company begins to

reduce production. AUO is one of the qualified candidates, and apparently it

is receiving more orders from notebook PC brands. AUO,

Innolux and other Taiwanese manufacturers and BOE and other Chinese suppliers

are all expanding IPS panels to respond to increasing panel requirements.

find other sources to replace Samsung Display, after the company begins to

reduce production. AUO is one of the qualified candidates, and apparently it

is receiving more orders from notebook PC brands. AUO,

Innolux and other Taiwanese manufacturers and BOE and other Chinese suppliers

are all expanding IPS panels to respond to increasing panel requirements.

For the LATEST tech updates,

FOLLOW us on our Twitter

LIKE us on our FaceBook

SUBSCRIBE to us on our YouTube Channel!